Employees earning above RM 34000 per year or RM 283333 per month are required to register a tax file. 1 Normal Remuneration Normal remuneration is a fixed monthly salary.

How To Calculate Your Income Tax Step By Step Guide For Income Tax Calculation Youtube

Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

. Calculate annual chargeable income. The next RM15000 of your chargeable income 13 of RM15000 RM1950. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified.

Those who fail to do so can face legal action so make sure you do your part and declare your income. Wait until you can see some PCB in your pay slip means HR help you pay PCB already. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500.

The Monthly Malaysia Tax Calculator is a diverse tool and we may refer to it as the monthly wage calculator monthly salary calculator or monthly after tax calculator it is. For a non-resident employee in Malaysia the net PCB should be 28 of his or her salary. So if salary RM2450 per month below then no need to pay tax right.

In Malaysia an individual earning RM34000 after deduction of EPF contributions per year is required to pay income tax. Calculate annual tax based on chargeable income and current tax rates. Malaysias tax authorities provide an official PCB calculator here.

Who should pay taxes. A quick and efficient way to compare monthly salaries in Malaysia in 2022 review income tax deductions for monthly income in Malaysia and estimate your 2022 tax returns for your Monthly Salary in Malaysia. And come april next year you need declare it.

Total monthly remuneration RM 500000. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Total annual income - eligible tax reliefs and deductions.

Total tax payable RM3750 before minus tax rebate if any However you dont have to memorise all this Simply use the income tax calculator in Malaysia that I recommended KiraCukaimy and itll automatically give your income tax guestimate. 13 rows 2000000. A individual who earns a taxable monthly income of RM283333 about or more is required to file a tax return.

All sources of income are taxed including overtime pay bonuses commissions business income dividends interest royalties and pensions. Meanwhile non-residents those staying in Malaysia for less than 182 days whose salary is not less than RM25000 and in higher positions such as C-level positions are taxed at a flat rate of 15 for five consecutive years. So what is the minimum amount of Salary that is required to be paid in income tax.

Net PCB RM 500000 x 28. Calculate monthly PCB by dividing annual tax by 12. But confirm those below.

According to Lembaga Hasil Dalam Negeri LHDNalso known as the Inland Revenue Boardthose earning at least RM34000 a year after EPF deductions need to pay taxes. Heres how this looks. A resident employees PCB calculation are categorised into four formulas.

How To Calculate Foreigner S Income Tax In China China Admissions

How To Calculate Income Tax In Excel

China Annual One Off Bonus What Is The Income Tax Policy Change

How To Calculate Income Tax In Excel

How To Sell Online Payslips To Your Employees Payroll Payroll Template National Insurance Number

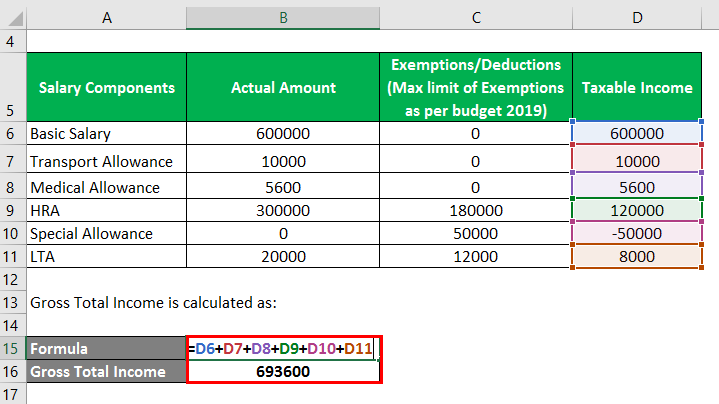

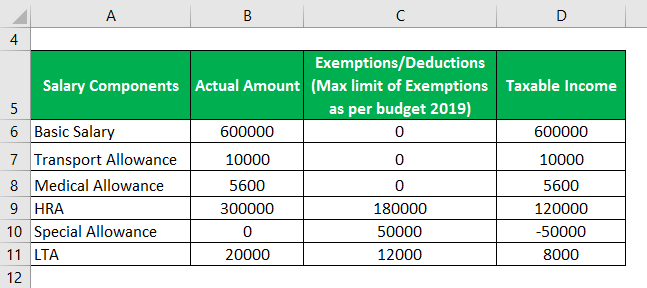

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

How Is Taxable Income Calculated How To Calculate Tax Liability

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

8 Things To Know About Us Tax For Expats Living In Cambodia

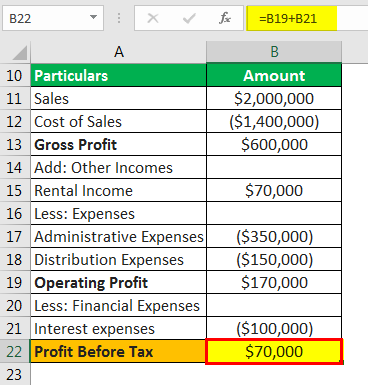

Provision For Income Tax Definition Formula Calculation Examples

What Is Life Like After Getting Selected In The Income Tax Department Quora

Salary Formula Calculate Salary Calculator Excel Template

Taxable Income Formula Calculator Examples With Excel Template

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018